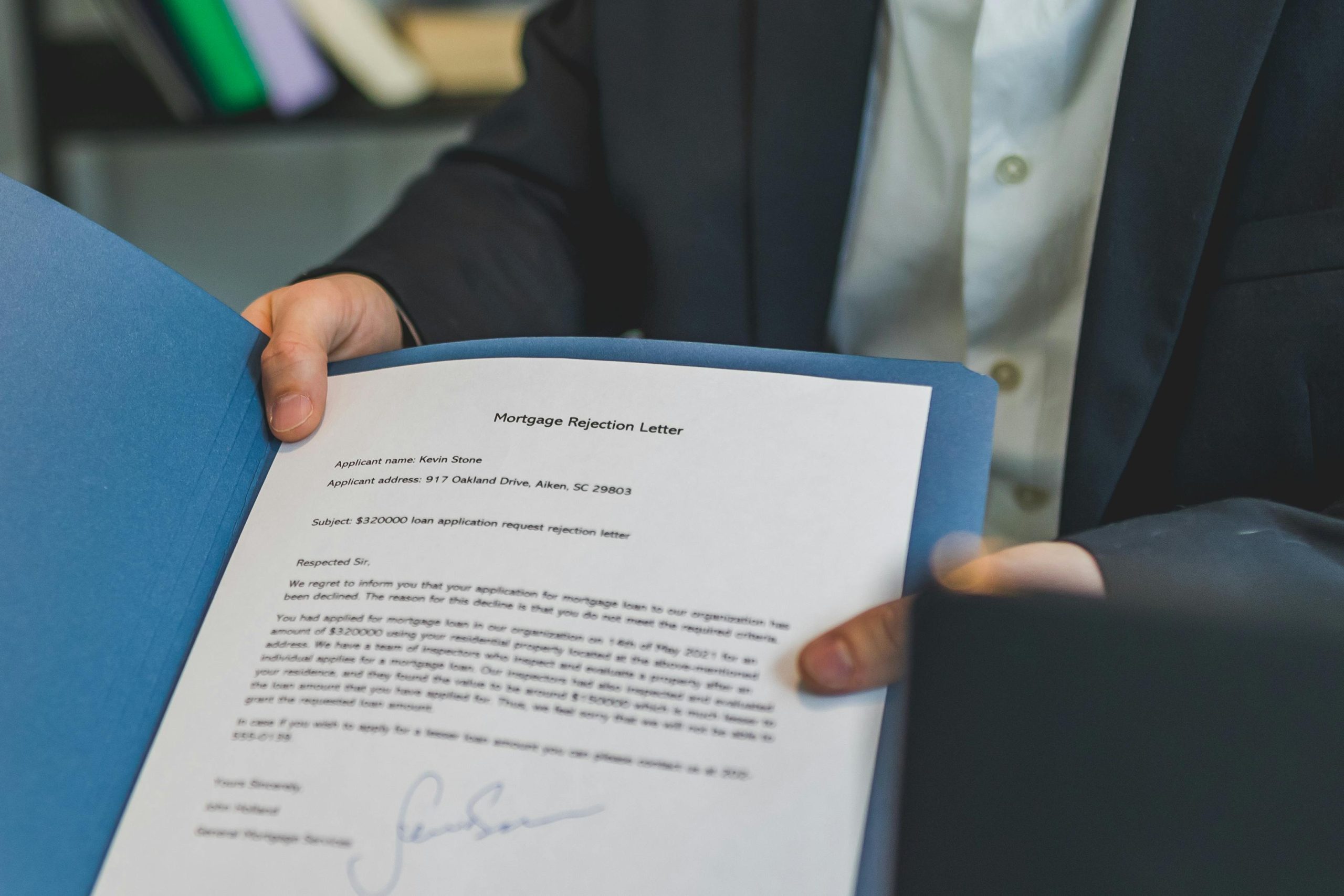

Applying for a loan can be a stressful experience, especially if you’re unsure whether your application will be approved. Rejection can delay your financial plans and even impact your credit score. However, with the right preparation and strategy, you can significantly increase your chances of approval. In this guide, we’ll share proven loan application tips to help you avoid rejection and secure the funding you need.

1. Check and Improve Your Credit Score

Your credit score is one of the most critical factors lenders consider when reviewing your loan application. A low score can lead to rejection or higher interest rates. Here’s how to ensure your credit score works in your favor:

- Review your credit report: Obtain a free copy from major credit bureaus and check for errors. Dispute any inaccuracies that could be dragging your score down.

- Pay down existing debt: Lowering your credit utilization ratio (the amount of credit you’re using compared to your limit) can boost your score.

- Avoid new credit applications: Multiple hard inquiries in a short period can negatively impact your score.

- Make timely payments: Consistently paying bills on time demonstrates financial responsibility.

What Credit Score Do You Need?

Different loans require different credit scores. For example:

- Personal loans: Typically require a score of 600 or higher.

- Mortgages: Conventional loans often need a score of 620+, while FHA loans may accept lower scores.

- Auto loans: A score of 660+ usually secures better rates.

2. Prepare a Strong Application with Accurate Information

Lenders scrutinize every detail in your application. Incomplete or incorrect information can lead to rejection. Follow these steps to submit a polished application:

- Provide complete documentation: This may include pay stubs, tax returns, bank statements, and proof of identity.

- Double-check all details: Ensure your name, address, income, and employment details match official records.

- Explain any red flags: If you have past financial issues (e.g., late payments), include a brief explanation to provide context.

Show Stable Income and Employment

Lenders prefer borrowers with steady income and job stability. If you’ve recently changed jobs or have irregular income, consider waiting until you have at least six months of consistent earnings before applying.

3. Choose the Right Loan and Lender

Not all loans or lenders are the same. Picking the wrong one can increase your chances of rejection. Here’s how to make the best choice:

- Compare loan types: Secured loans (backed by collateral) are easier to qualify for than unsecured loans.

- Research lenders: Traditional banks, credit unions, and online lenders have different approval criteria. Some specialize in borrowers with lower credit scores.

- Pre-qualify when possible: Many lenders offer pre-qualification, which gives you an estimate of approval odds without a hard credit check.

Understand the Lender’s Requirements

Before applying, review the lender’s eligibility criteria. Common requirements include:

- Minimum credit score

- Debt-to-income (DTI) ratio below a certain threshold (usually 36-43%)

- Proof of income and employment

4. Manage Your Debt-to-Income Ratio (DTI)

Your DTI ratio compares your monthly debt payments to your gross income. A high DTI suggests you may struggle to repay a new loan. Here’s how to improve it:

- Pay off small debts: Reducing credit card balances or other loans can lower your DTI.

- Increase your income: If possible, take on a side gig or overtime to boost your earnings.

- Avoid taking on new debt: Wait until after your loan is approved to apply for additional credit.

Calculate Your DTI

To determine your DTI, add up all monthly debt payments (e.g., rent, car loans, credit cards) and divide by your gross monthly income. Multiply by 100 to get a percentage. Aim for a DTI below 36% for the best approval odds.

5. Consider a Co-Signer or Collateral

If your credit or income isn’t strong enough, adding a co-signer or offering collateral can improve your chances of approval.

- Co-signer: A trusted person with good credit agrees to repay the loan if you default. This reduces the lender’s risk.

- Collateral: Secured loans (e.g., auto loans, home equity loans) use assets like a car or house as security, making approval easier.

Risks to Consider

While these options help, they come with risks. A co-signer’s credit is on the line, and collateral could be seized if you default. Only use these strategies if you’re confident in your ability to repay.

Conclusion

Loan rejections can be frustrating, but they’re often avoidable with careful planning. By improving your credit score, submitting a thorough application, choosing the right lender, managing your DTI, and leveraging co-signers or collateral when needed, you can boost your approval odds. Take the time to prepare, and you’ll be well on your way to securing the loan you need.