When you’re in the market for a loan—whether it’s for a home, car, or personal expense—you’ll likely come across terms like “pre-qualified” and “pre-approved.” While they may sound similar, they represent different stages in the loan application process. Understanding the distinctions between pre-qualified and pre-approved loan offers can help you make informed financial decisions and improve your chances of securing the best terms.

What Does Pre-Qualified Mean?

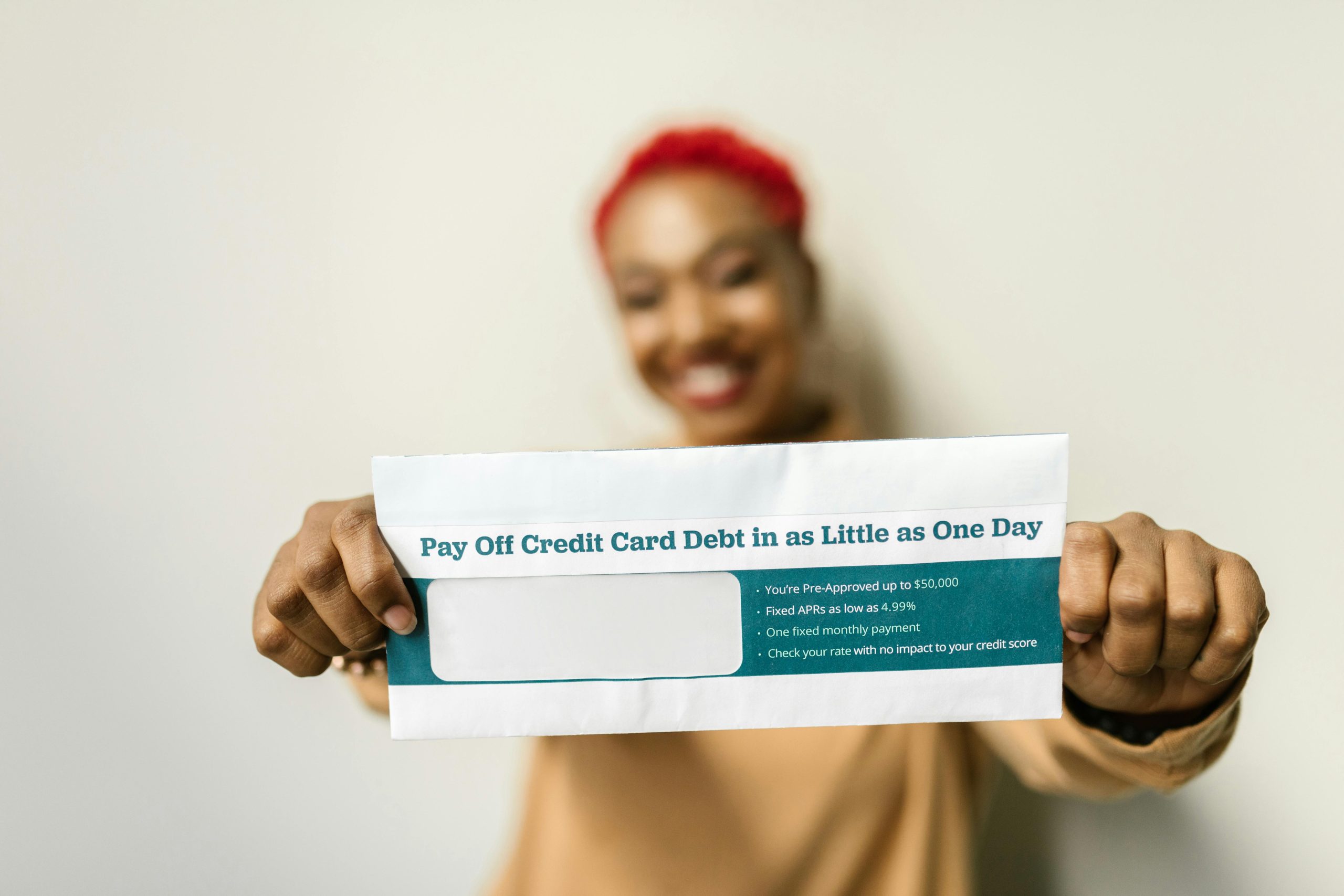

A pre-qualified loan offer is an initial assessment of your financial situation by a lender. It gives you a rough estimate of how much you might be able to borrow based on the information you provide. This step is typically quick, informal, and doesn’t require a hard credit check, meaning it won’t impact your credit score.

How Does Pre-Qualification Work?

To get pre-qualified, you’ll usually need to share basic financial details, such as:

- Your income

- Employment status

- Estimated credit score

- Existing debts

Based on this information, the lender provides a ballpark figure for how much you might qualify to borrow. However, a pre-qualification is not a guarantee—it’s simply a starting point.

What Does Pre-Approved Mean?

A pre-approved loan offer is a more formal and rigorous step in the loan process. It involves a lender reviewing your credit history, income, and other financial documents to determine whether you meet their lending criteria. Unlike pre-qualification, pre-approval often requires a hard credit inquiry, which can temporarily lower your credit score.

How Does Pre-Approval Work?

To get pre-approved, you’ll typically need to submit:

- Proof of income (pay stubs, tax returns)

- Bank statements

- Employment verification

- Credit report authorization

Once the lender verifies your details, they may issue a pre-approval letter, which states the loan amount, interest rate, and terms you qualify for. This letter carries more weight than a pre-qualification and can strengthen your position when negotiating with sellers or dealerships.

Key Differences Between Pre-Qualified and Pre-Approved Loans

While both terms relate to loan eligibility, they serve different purposes and involve varying levels of scrutiny. Here’s a breakdown of the main differences:

1. Level of Verification

Pre-qualification is based on self-reported information and doesn’t require documentation. Pre-approval, on the other hand, involves a thorough review of your financial records.

2. Impact on Credit Score

Pre-qualification usually involves a soft credit check, which doesn’t affect your credit score. Pre-approval typically requires a hard inquiry, which can cause a slight dip in your score.

3. Strength of Offer

A pre-qualification is an estimate, while a pre-approval is a conditional commitment from the lender. Sellers and lenders take pre-approval more seriously because it indicates a higher likelihood of loan approval.

4. Time and Effort

Pre-qualification is quick and easy, often completed online in minutes. Pre-approval takes longer, sometimes days or weeks, due to the detailed verification process.

When Should You Get Pre-Qualified vs. Pre-Approved?

Choosing between pre-qualification and pre-approval depends on your financial goals and where you are in the borrowing process.

Pre-Qualification Is Best For:

- First-time borrowers exploring loan options

- Those who want a quick estimate without a credit check

- Individuals still comparing lenders and loan types

Pre-Approval Is Best For:

- Serious buyers ready to make a purchase (e.g., home or car)

- Those who want to strengthen their negotiating power

- Borrowers looking for precise loan terms and interest rates

Conclusion

Understanding the difference between pre-qualified and pre-approved loan offers can save you time and improve your borrowing experience. Pre-qualification is a useful first step for estimating loan amounts, while pre-approval provides a more concrete offer backed by verified financial data. If you’re serious about securing a loan, especially for major purchases like a home or car, getting pre-approved can give you a competitive edge. Always compare multiple lenders and read the fine print to ensure you get the best deal possible.